Blogs

The people of Esri UK sharing what we do, what inspires us and how we get the most out of the ArcGIS technology to help you improve your knowledge and deliver greater value across your organisation.

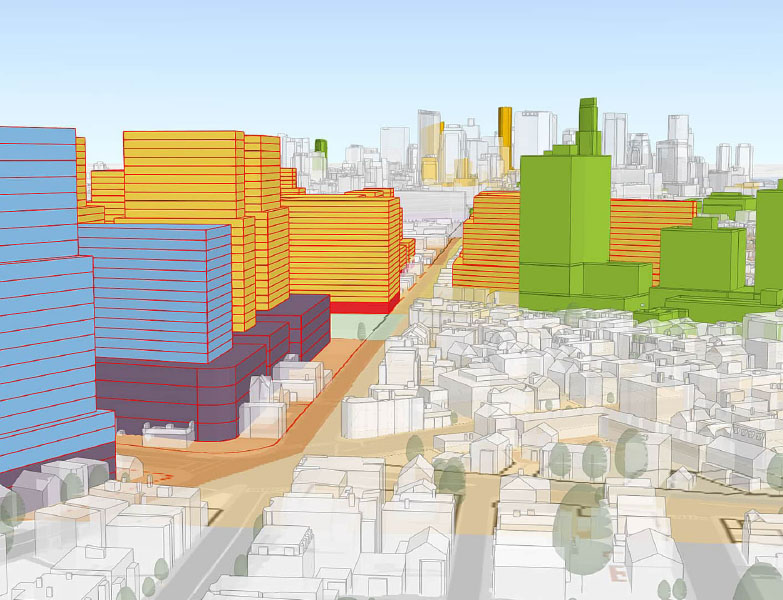

Case Studies

Our customers are solving some of the world’s most complex challenges using ArcGIS. Read their inspiring stories to learn how you can deliver improved customers services, modernise working practices or improve operational efficiency.

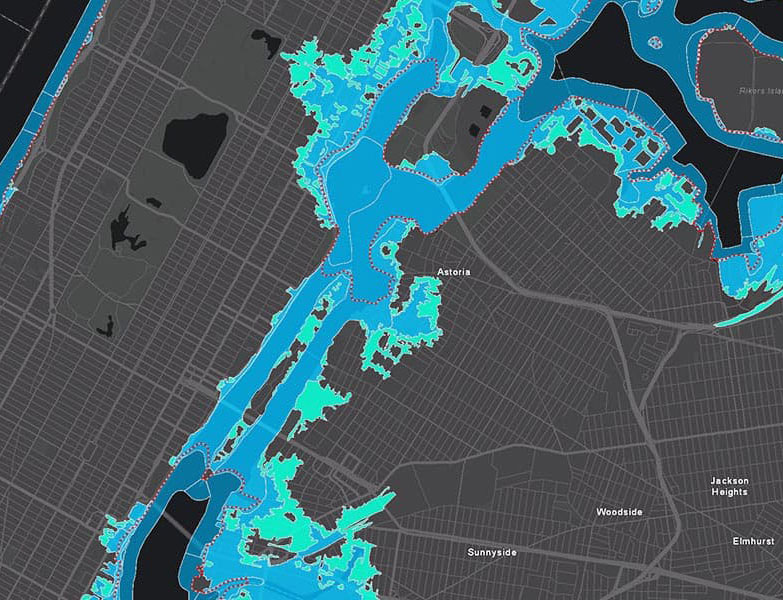

Media Maps

Explore our gallery of maps in the media to see how leading news outlets such as the BBC, Times, Guardian, Telegraph and The Mirror have embedded Esri digital maps into breaking news stories.

In the News

The latest coverage about Esri UK and our customers, directly from leading news outlets and media companies.

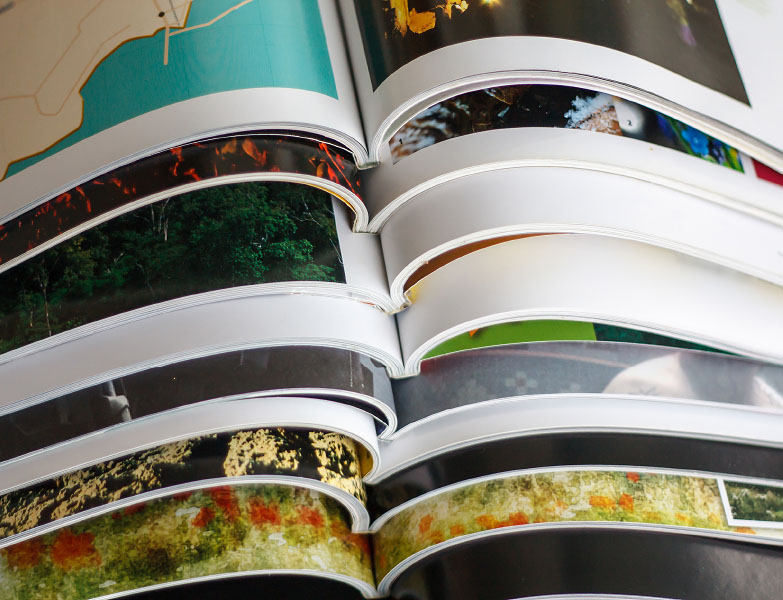

Media Relations

Esri UK is committed to helping members of the media tell compelling stories. Our ready to use templates help you to combine pictures, text and images into a digital StoryMap that can then be shared online to engage with communities