While the newspaper industry shifts its strategies to meet the challenges of an ever-changing digital age, one well-respected media company has found an innovative way to turn prospective customers into loyal advertising partners.

The Star Tribune Media Company in Minneapolis has created a twist on the traditional newspaper-advertiser relationship. Instead of simply selling ad space in its print and digital channels, the Star Tribune consults prospective advertisers on market development, including how they might grow their business.

Using sophisticated geographic information system (GIS) technology, the Star Tribune delivers this high-value location intelligence without charge and without a customer commitment. The same work by an outside consultant could cost tens of thousands of dollars.

Why is the Star Tribune willing to offer so much to attract a potential customer? In large part, because the location-based analysis it produces is the quickest way to show prospects the value of partnering with the Star Tribune.

Swimming against the Industry Tide

The Star Tribune’s approach to sales has helped attract and retain customers during a difficult period for the publishing world. In a 2017 report, the Pew Research Centre found that with few exceptions, newspapers faced declining revenue during the past several years, and that total weekday circulation for US daily newspapers (counting print and digital) dropped 8 percent in 2016.

The Star Tribune has been abler than most to swim against this industry tide by keeping print products strong, developing digital platforms for news, and serving as a partner and consultant to advertisers.

While many companies promise to partner with customers after the sale, the Star Tribune often delivers vital location intelligence—at no cost—even before an advertising contract is signed.

“We don’t have any hesitation about that,” says Steve Yaeger, vice president and chief marketing officer for the Star Tribune. “Because the type of analysis that we do will open up all kinds of other insights about your business, and it will lead you to make a decision for the Star Tribune.”

Knowing Where and How to Develop Markets

The Star Tribune’s complimentary, GIS-powered analysis focuses on market development. It tells an organization the location and interests of customers and identifies which advertising channels are likely to be most effective. This location intelligence gives a prospective advertiser confidence in the Star Tribune’s solutions and, in turn, helps the Star Tribune hit the ground running if the company decides to advertise.

This approach has led to a growing group of clients that range from single-location, higher-end merchandisers and organizations to companies with revenue in the billions. All have enough trust in both the GIS results and the Star Tribune to do something that’s rarely seen in the business world: they share their transactional customer database for analysis by the Star Tribune’s marketing department GIS team.

The media company signs privacy and nondisclosure agreements with businesses that share such data. Yaeger takes pains to note that while the newsroom uses GIS to conduct research and create maps for news stories, the marketing department’s GIS team is completely separate.

Sometimes [an advertiser] might be over-saturating an area that's not producing for [them], and it's not at all uncommon for us to tell an advertiser to reduce their spend in a given geography.

Steve Yaeger, Star

Tribune CMO

A History of Customer Partnership

Some business analysts caution against using free consultations because they can be worthless gestures or, at the other extreme, profit-killing giveaways of valuable products or services. But the Star Tribune has struck a unique balance.

Wayne Johansen, founder of the $250 million HOM Furniture, was the first customer to use the Star Tribune’s market development guidance. He credits mapping and demographic analysis for supporting his company’s fast rise and says HOM Furniture has maintained its success through ongoing market analysis.

Of his early days in the business, Johansen says: “We were in a fast-growth stage and we felt that we had a winning game plan. But the execution became much more scientific and precise with the tools and analysis we were able to get from the Star Tribune.” Johansen’s company recently was ranked eighth among the top 50 regional furniture chains.

Based on the experience with HOM Furniture and other early clients, the newspaper took the unusual step of creating its own GIS Customer Analytics Department with a director and two full-time GIS analysts.

Carlos Ruiz, the director, says many prospective advertisers struggle to understand who and where their best customers are.

“The No. 1 question we try to answer is: Where are your customers coming from? And that seems like a simple question. Most advertisers with physical store locations have a gut feeling of where their customers are located and how far they will drive.”

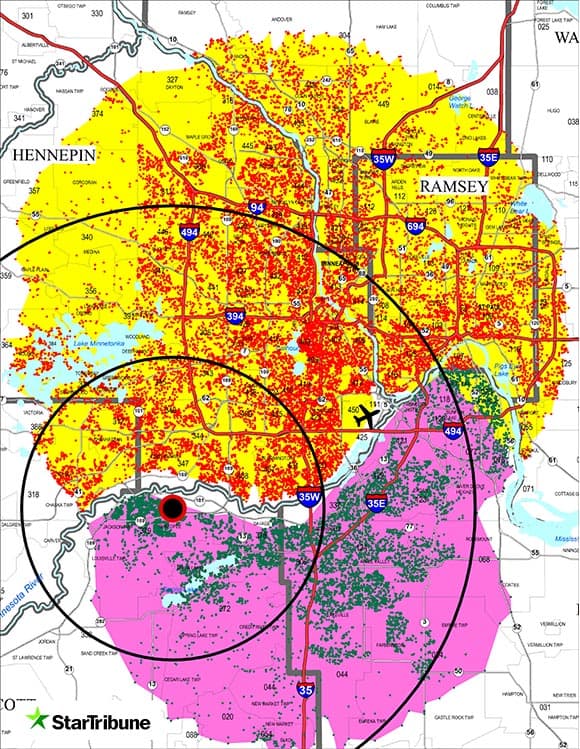

But when Ruiz and his colleagues analyse a company’s database and plot its customers’ locations on a GIS-powered map, the business owners often are surprised. “More often than not, the mean centre of the customers’ spatial distribution is a mile, or three miles, or even five miles away from the store location.” (See the image at right for an example.)

Once the advertiser sees that high-level location intelligence, Ruiz explains how deeper analysis can sift out customer traits—their locations, interests, age, gender, and purchase history with the business. (See the sidebar, “The Science behind the Insight.”) That step is key to successful market development, since it helps reveal the best way to reach the people who are likely to become customers.

Planning Ad Campaigns Based on Location Intelligence

Even successful organizations with deep local roots can find the research eye-opening. In one case, a well-regarded arts organization was certain that its main event location was the geographic centre of its customer base, and that some members would not drive across the Minneapolis Saint Paul region to attend events there.

But the Star Tribune’s analysis of the group’s transactional database showed that customers were much more spread out and willing to drive long distances. When the GIS analysts added to the customer distribution map several layers of demographic traits such as age, income, home ownership rates, shopping and travel preferences, and other personal interests, they found previously undiscovered patterns.

By analysing their actual transactional databases, we can help our advertisers to make sound marketing decisions based on actual facts instead of just intuition.

Carlos Ruiz, Director, Star Tribune Customer Analytics

“We can tell an advertiser that X percent of your business is coming from customers who look like this,” Yaeger says. “They’re living in these locations. . . . If you could reach more people who look like this or who live in these areas, then chances are you would do well with them.”

After digesting the surprising GIS findings, the group re-examined its strategies for reaching out through a variety of print, online, direct mail, and digital products offered by the Star Tribune that they had previously underutilized.

Matching Customer Segments to Digital and Print Ad Campaigns

The Science behind the Insight

Purveyors of GIS technology have taken a scientific approach to understanding consumers. Decades of research, for instance, have shown that customers who share particular characteristics tend to exhibit similar purchasing habits. GIS technology identifies where certain groups of those consumers live and where they might shop. For more, see, “The Enterprise Technology behind Big Business Decisions.”

The Star Tribune is proud of the fact that although Minneapolis Saint Paul is the sixteenth largest metro area in the country, the newspaper has managed to rank fifth in the nation in Sunday print circulation.

Meanwhile, the Star Tribune takes its own advice, examining its database to figure who its core customers are, and where to find more of them. Recently, that GIS research indicated support for adding two other print options (a weekly household-requested free newspaper that’s an abridged version of the daily newspaper, and an advertiser supported “shopper” product). With that, the paper’s print products now reach 1 million unduplicated households—a plus for readers and advertisers. The company’s expanding digital products draw 8 million unique visits each month.

As business leaders know well, a digital strategy is a key part of market development. Using customer demographic information, interests, and purchasing history, Star Tribune advertisers can aim digital ads toward certain types of people who read the newspaper online. The newspaper’s revenue from digital services was about 5 percent of its revenue in 2013 and 10 percent in 2016, and is on track to hit 15 percent by 2020.

The Star Tribune’s GIS mapping helped us pick new store locations, forecast sales, and in one case, it showed us that we should go ahead and close a smaller location and open up a larger one elsewhere.

Wayne Johansen, HOM Furniture

Location Intelligence and Business Instincts Guide Market Development

Johansen of HOM Furniture is something of an instinctual businessman—one who had the savvy to recognize a Midwestern market ripe for his retail furniture stores. He even picked some of the first locations himself. But Johansen also realized he needed new technologies to support the growth he envisioned.

In one of the first analyses Johansen received from the Star Tribune, Ruiz overlaid demographic data on a map of HOM’s customer distribution, revealing in precise detail how location, income, age, family size, and lifestyle interests related to the types of furniture that customers were buying at different HOM stores. “We were surprised by how concentrated some of our business was in some [customer] segments,” Johansen says.

Ruiz helped the company figure out how to identify store locations that would reach new customers without losing current ones. Location intelligence also worked on subtler levels, leading Johansen to maximize sales by stocking different items at different outlets—all based on the predicted buying patterns of people likely to patronize each location.

As HOM Furniture grew, its advertising grew as well. The company increased its purchase of multipage, colourful inserts from about 10 annually to more than 40 a year. HOM also added new Star Tribune advertising products from direct mail to digital outreach, as the location intelligence supported those strategies.

“What was happening was that they were lifting our boat and we were lifting theirs at the same time,” Johansen says. “The Star Tribune’s GIS mapping helped us pick new store locations, forecast sales, and in one case, it showed us that we should go ahead and close a smaller location and open up a larger one elsewhere to more efficiently serve that area.”

Insight for Inventory Adjustments

Later, as competition and profit margins tightened, HOM Furniture’s partnership with the Star Tribune paid a new kind of dividend. Johansen found that his company could profit not only from expansion, but also from adjusting marketing activities based on the locations of customers and competitive specialty stores. “The Star Tribune helped us find certain categories like mattresses and break out some of those numbers to identify places where there’s not as much competition for those products,” Johansen explains.

Even if more mattress stores later moved close by, pushing HOM to decrease its emphasis on the product in those areas, the Star Tribune still helped them uncover a profitable vein that they might not have seen as quickly, or at all.

Ruiz and Yaeger are pleased with the long-term relationships that have flourished since the first round of free consultation with HOM Furniture years ago. That initial partnership formed the Star Tribune’s template for helping prospective clients develop their markets based on location intelligence.

“We want to [do] more than just sell advertising,” Ruiz says of the Star Tribune’s approach. “We want to become partners with our advertisers.”