Blog Archives

Post navigation

The Business Executive’s Blueprint for Sustainability

A blueprint for resilience and reduction, two essential practices for executives overseeing the long-term health of their business

In boardrooms around the world, a new reality is sinking in: Those organizations best able to marshal data to absorb, avoid, or reduce climate risk—and find opportunity in the tumultuous years ahead—will hold significant competitive advantage and better reflect society’s values.

Article snapshot: For C-suite leaders, two practices have come to define sustainability: resilience and reduction. Here we illustrate how some of the world’s best-known companies use these practices to strengthen long-term viability.

In the wake of an unbroken series of extreme climate events that have disrupted supply lines, devastated communities and businesses, and dramatically altered markets, company leaders are digesting the news that a global temperature rise of 3.2°C could wipe out nearly a fifth of global GDP—$15 trillion in today’s dollars—by 2050.

With disruption and uncertainty the new normal, what’s clear is that the traditional list of factors in any major business decision—revenue, brand identity, market share—now has another strategic layer: sustainability. The urgency behind the sustainability imperative is not just born of charitable intentions and corporate social responsibility; it’s recognized as a matter of basic business continuity and survival.

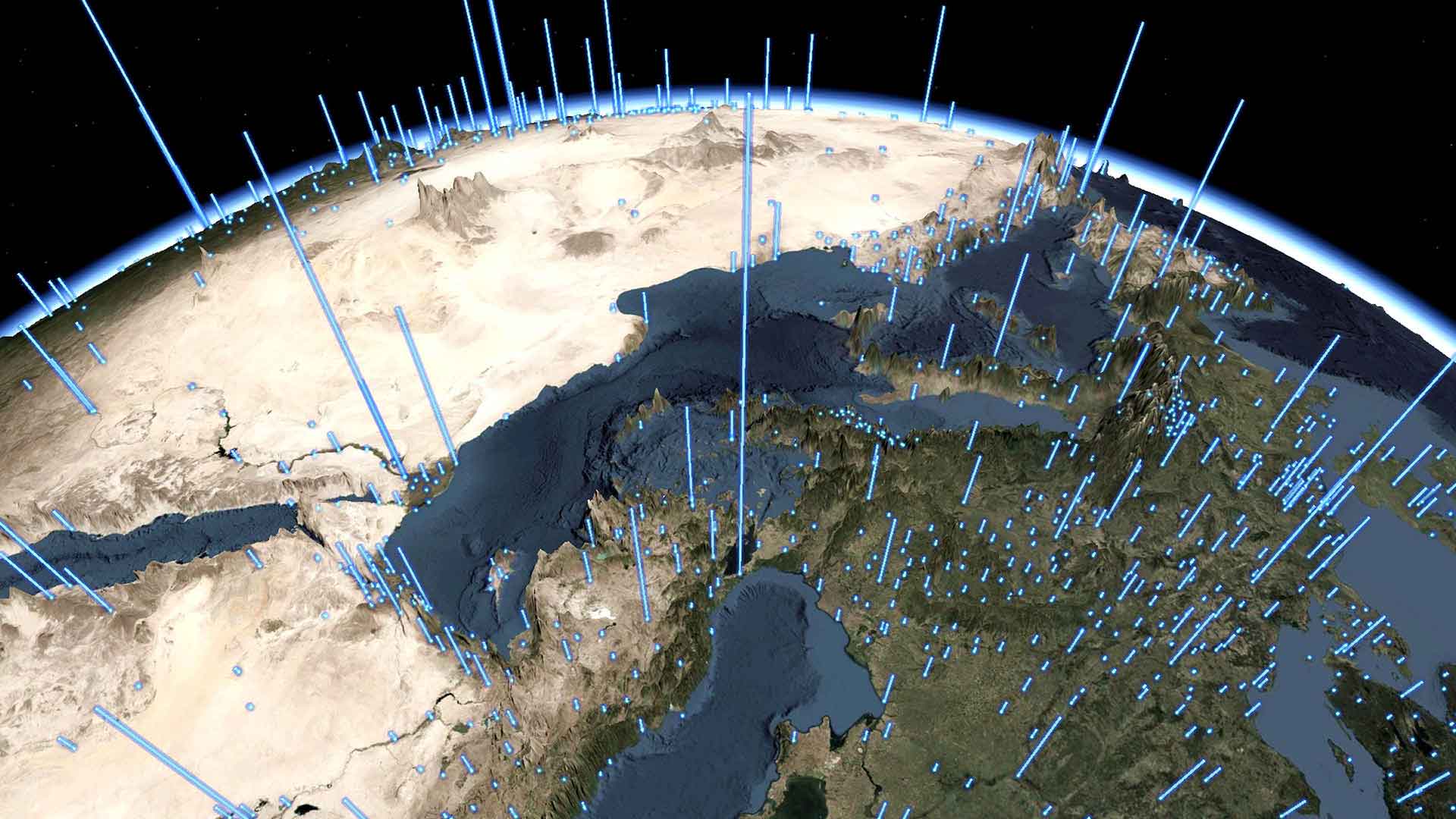

Geography looms large for scientists in the fight against climate change—likewise, executives are taking a geographic approach backed by data science to understand where assets lie in relation to climate threats, like flooding or excessive heat, and to visualize how company actions affect the environment. Some of the world’s biggest and most powerful retailers, shippers, and manufacturers rely on a modern geographic information system, or GIS, to supply this unified perspective on operations, vulnerabilities, and impacts.

The spatial awareness provided by GIS, known as location intelligence, reveals patterns and connections that would be lost in a spreadsheet. Executives can visualize business metrics, weather predictions, and other key data that vary dramatically by location. For instance,

International businesses must also navigate climate-related regulations and legislation unique to each country. With GIS, executives can analyse these complex data streams in a familiar format—a map—and easily share findings with fellow executive stakeholders.

Location intelligence can transform decision-making in the many places where sustainability meshes with daily business operations and long-term planning (see sidebar “How GIS Contributes to Sustainable Business”). For executives overseeing site selection, supply chain management, field operations, and sales and marketing, spatial analysis guides them toward a better relationship with the environment and a healthier business future.

Resilience and Reduction: The Twin Engines of a Climate Sustainability Strategy

In a sign of how seriously CXOs are taking sustainability, decision-making power around climate issues now often resides with the chief risk officer or CFO. These executives have defined two primary sustainability strategies: resilience and reduction.

Resilience efforts are about defending an organization against climate impacts and withstanding such impacts when they are impossible to sidestep. It’s a concept that lies at the heart of modern business continuity. Reduction, on the other hand, describes actions that companies take to minimize harmful impacts on the environment. For many companies, reduction takes the form of eliminating or minimizing greenhouse gas (GHG) emissions. According to a recent report, at least a fifth of the world’s biggest 2,000 public companies are currently committed to net-zero emission targets.

Resilience and reduction are two sides of the same coin: a company that optimizes transportation routes to reduce its carbon footprint, for instance, also creates a more streamlined network that may be less exposed to floods, storms, and other climate hazards. An organization that retools operations to use fewer natural resources also ensures a healthier supply of that resource in the future. Whether interrelated or taken apart, resilience and reduction strategies are best understood and implemented through the lens of location intelligence.

In the short term, GIS offers a “single pane of glass” through which decision-makers can anticipate weather events to ensure employee and customer safety, create location-specific mitigation strategies, and coordinate efforts to minimize disruptions and maintain continuity. In the long term, GIS-based modelling can flag the location of worsening climate conditions, prompting business leaders to harden or relocate assets and infrastructure that are needed to serve the next generation.

By modelling facilities or supply chains into a digital twin—complete with data from IoT sensors and satellite or drone imagery—executives gain a comprehensive view of business activity across land and sea. From this vantage point, they can analyse supply chain impacts, create more efficient routing, and ensure long-term responsible use of resources.

Thanks to the long reach of IoT data and location technology, companies can surface these insights without dispatching employees and vehicles to far-flung locations—another way for a business to meet net-zero and other reduction goals.

How GIS Contributes to a Sustainable Business

Combined with data from IoT sensors monitoring production equipment, buildings, vehicles, and other assets—along with imagery and remote sensing technology—GIS can be the backbone of a company’s collective sustainability efforts:

Resilience

- Daily operational awareness: Real-time location data creates visibility into impending weather events and potential impacts on people, facilities, assets, partners, and supply lines.

- Business strategy and planning: Predictive modelling of climate risks informs long-range decisions on where to invest in facilities, sourcing, production, infrastructure, labour force, and markets.

Reduction

- Daily operations: Analytics helps companies track emissions from production facilities, vehicle fleets, stores, offices, and more. It also monitors consumption of natural resources across the business. GIS communication tools and public maps contextualize threats to employees, partners, and communities.

- Business planning and strategy: Dashboards show a geographic view of the company’s progress toward net-zero initiatives. Smart maps communicate company progress to stakeholders, financial backers, regulators, and customers.

No Exit from a World of Climate Change

A host of motivations has forced climate onto the C-suite docket, and no industry or region has been spared. Business activity itself is slowed by worsening climate conditions: researchers have found that poor air quality reduces shopping activity, and rising heat cuts into worker productivity. The COVID-19 pandemic has demonstrated that in today’s globalized economy, knock-on effects can ricochet from loading docks in Vietnam to store shelves in Minneapolis within days and linger for months or longer.

Companies that rely on natural resources must guarantee that their source materials won’t be wiped out by rising temperatures, droughts, deteriorating biodiversity, or floods. Meanwhile, storms and cyclones have picked up in nearly every corner of the globe, wreaking havoc on assets and causing flooding that can shutter small businesses and restaurants. US flood insurance rates are set to increase for 77 percent of policyholders, according to a recent study.

Consumer sentiment is also changing dramatically, as younger generations leverage their wallets to reward organizations that practice holistic sustainability. On a recent WhereNext webcast, a snap poll revealed that competitive differentiation and brand leadership were the main drivers of sustainability efforts. Insurance firms are pushing companies to build climate risk analysis into asset evaluations, and Wall Street banks want to protect investments from long-term climate disruptions.

C-suite leaders are even feeling the effects of this turning tide on a personal level. A growing number of CEOs now find their bonuses tied to environmental goals. Meanwhile, activist investors are successfully pressuring some the world’s most powerful companies into taking the difficult steps necessary to cut carbon emissions.

BlackRock CEO Larry Fink, head of the world’s largest money manager, has been among the most vocal leaders in pushing companies to build sustainability into their business models, citing a “tectonic shift.” That shift and the urgency it reflects are written in the numbers: For the first time, banks are committing more financing to green bonds and loans than to fossil fuel, according to recent Bloomberg data.

GIS: An Organization’s Central Nervous System for Resilience and Reduction

For many C-suite leaders, resilience has been elevated to a top-line priority because weather events and other threats are affecting their ability to fulfil customer expectations day in and day out. Resiliency could roughly be described as a defensive posture—but as with any great defence, it contains elements of proactive offense.

GIS furnishes companies with a central digital nervous system that contextualises and analyses data. Leaders can use this system both to inform long-term resilience strategies and respond to near-term dangers triggered by weather or climate events. Location-savvy organisations—including one of the world’s largest retailers—rely on real-time, GIS-powered dashboards as the brain of emergency operations centres (EOC) and global security operations centres (GSOC).

As data on potential natural disasters flows to these centres of operational awareness, decision-makers can weigh complex factors and coordinate fast, precise responses.

By adopting a geographic approach, business leaders can see weather events developing and begin enacting location-specific mitigation strategies. Data layers showing climate patterns reveal where rainfall has historically led to river flooding, and how that might affect properties, employees, and communities. With advance knowledge of impending weather events, a tech company can warn employees not to commute into the office, a restaurant chain can stock up on shelf-stable goods, and a manufacturer can order components from an alternate supplier.

Location intelligence generated from GIS software empowers companies to not only improve their own resilience, but also strengthen the communities where they operate. The major retailer cited above orchestrates natural disaster responses with local and state governments and relief organizations. Dashboards can identify store parking lots where displaced families might gather, or where surpluses of critical supplies could be staged. During Hurricane Florence, the company’s spatial awareness enabled the emergency team to source and donate massive air conditioners, which were airlifted to a sweltering North Carolina shelter completely surrounded by water.

50- and 100-Year Business Continuity Planning

To ensure long-term resilience, companies are using cutting-edge tools like AI and machine learning in conjunction with GIS to map patterns in climate data decades into the future. By aligning investments with those predicted trends, a business can avoid pouring resources into areas with a high chance of being underwater in 30 years or wiped out by forest fire. Examples include:

- AT&T is carrying out advanced spatial analysis of climate risks that goes far beyond examining FEMA floodplain data. Through a partnership with the US Department of Energy’s Argonne National Laboratory, the world’s largest telecom company has created forecasts showing how infrastructure like cell towers or base stations could be affected by 50-year storms. The granularity of this data allows AT&T to anticipate with 95 percent confidence that a given 200 square-meter plot of coastal land will see 15 feet of maximum flooding in the coming decades. By layering those models onto GIS-based smart maps, decision-makers can make the call about which assets to strengthen or relocate, which in turn helps keep internet access on in challenging conditions.

- The furniture giant IKEA uses 700 million cubic feet of wood a year. That reliance on a natural resource and commodity that can take 140 years to mature has made sustainable forestry a vital interest for the company. The investment arm of Ingka Group, which operates the majority of IKEA stores worldwide, owns swaths of forest in the US and Eastern Europe. It uses location intelligence to guide ecologically sound methods of timberland management. Based on data from field agents and satellite imagery, the company’s location analysts can identify which tracts contain tree species most vulnerable to threats like the invasive bark beetle. With this information, they can prioritize areas that need protective treatments, staving off costly losses. Because much of this data can be tracked through technology like remote imagery, Ingka minimizes its own environmental impact on the regions where it operates. The company relies on GIS to monitor biodiversity measures like the health and population levels of animal, plant, and insect species on its properties. This holistic understanding of woodlands and the ecosystems they maintain is integral to maintaining long-lived, productive forests.

- Taylor Shellfish Farms, the largest shellfish producer in the US, with farms extending across 10,000 acres of Pacific Northwest tidelands, knows that keeping a sustainable supply of food and drink on our dinner tables requires resource planning on the scale of decades, not months. Company leaders use pH sensors and GIS to track the acidity of ocean water and determine how well oysters respond. By comparing farms and identifying techniques that lead to improvement, they’ve been able to grow in spite of climate-related disruptions that have crippled other hatcheries.

Companies across the manufacturing sector—from pharmaceutical giants to soda makers—are turning to location intelligence to assess and reduce water use, concerned that unchecked consumption could create long-term scarcity at production facilities and in surrounding communities.

The Net-Zero Zeitgeist

As many of the most influential companies in the world sign on to net-zero commitments, it’s increasingly evident that achieving these goals could fundamentally shift how businesses source and ship goods and materials and alter the kinds of partners they work with. In September, 86 companies including Salesforce, Procter & Gamble, and HP joined an Amazon-led initiative to be carbon-free in their operations by 2040. The list of businesses that have taken the Climate Pledge now numbers over 200, collectively employing more than seven million people. To cut greenhouse gas emissions and reach these lofty goals, businesses will need visibility into their own operations and a precise view of where they can make the biggest cuts.

In 2019, almost a quarter of greenhouse gas emissions came from industrial production, according to the US Environmental Protection Agency. With the effects of climate change already striking at the bottom line of many companies, executives can see that contributing to global warming will ultimately hinder their own success and viability. That’s made reduction a strategy for business survival.

By necessity, reduction strategies must extend beyond greenhouse gases to account for the natural world in all its complexity. Companies are becoming more mindful that diminished ecosystems lead to resource-poor environments and land that can’t recover from climate change. Farms and forests with strong biodiversity ratings are ultimately more resilient and productive. It’s yet another motivation for businesses to develop a detailed picture of how they use resources and impact the environment, and where efficiencies might escape the naked eye.

Reduction: When Less is more

Location intelligence supports reduction efforts on a number of fronts, helping executives stay accountable as their organizations lower greenhouse gas emissions. Dashboards allow executives to monitor offices, stores, and factories, along with their GHG metrics. GIS-based planning is essential in sourcing natural resources sustainably, and the technology also aids communication: web-based smart maps help companies share reduction results with customers, investors, and the public.

The example of a large European grocery chain shows how the positive benefits of reduction can ripple through an organization. Already ranked first in global sustainability studies, the grocer decided to use GIS to move toward holistic sustainability. Reducing the CO2 emissions of its fleet of vehicles allowed the company to hone its competitive advantage both as a brand and an efficient operator. The company employed GIS to unite multiple data streams related to emissions—creating a big-picture visualization that empowered smart decision-making.

Using an algorithm that accounted for the effects of road slope, speed, load factor, and other parameters, company leaders were able to calculate the emissions for every engine type in its fleet, from diesel to electric, across all transportation routes. By feeding this information into smart maps, the company confidently predicted which engines would be most efficient for each route, identifying adjustments that would optimize fleet performance, eliminate carbon emissions, and reduce costs.

Sustainability’s Two Missing Rs: Regulation and Regeneration

Location intelligence fuels two additional sustainability strategies: regeneration and reporting. Companies like outdoor clothing retailer Patagonia that rely on agricultural products are helping to popularize regenerative farming practices. Indigo Ag and others are using location intelligence to measure the results of regenerative practices, such as composting, no-till farming, and crop rotation, which can trap carbon in the soil and reverse nutrient depletion.

Meanwhile, governments and investors are increasing pressure on companies to disclose environmental impacts. A new set of rigorous green disclosure requirements in the UK, for instance, will require large businesses, among others, to release sustainability data.

Spatially enabled companies have a unique advantage in complying with new regulations. Sensors and location dashboards help executives gather and organize relevant data, while maps are among the best ways to communicate and contextualize sustainability reporting for the public, regulators, and investors.

The Long Reach of Location Intelligence

Combining GIS with data from satellite imagery, drones, and IoT sensors gives decision-makers access to patterns that would have been invisible even a few years ago. By reducing the need for in-person visits to sites or assets in the field, companies gain accuracy and cost savings while reducing environmental impacts.

A recent investigation of deforestation in the Amazon shows the power of these technologies. An ecologist concerned about actions taken by a cacao company in the Peruvian rain forest relied on geospatial analysis and remote sensing to prove that old-growth forests had been illegally logged. A company could use the same tools to vet overseas partners or monitor the effects of its own operations.

Supply chains are attracting attention as a major source of carbon emissions and a place where route optimization could make a big impact on sustainability goals. According to analysis by the Boston Consulting Group, eight supply chains account for over 50 percent of greenhouse gas emissions each year.

New location-aware tools are helping businesses visualize how their footprints extend across global shipping lanes. For instance, the Seaport Simulator, developed by design and engineering firm Atkins, uses overhead lidar imaging to plot a seaport down to the height of seawater at the docks. This digital twin also extends across oceans, revealing partner ports, shipment data, population data, maritime travel routes, and climate patterns—a comprehensive, GIS-based picture of materials en route in all directions. Location analysts have been testing how resilient supply routes will be to climate disruptions, but a similar process could be used to run simulations on which alternate shipping lanes best support reduction and decarbonization.

Seventh Generation Decision-Making

When the world moved at a slower pace, society and businesses thought in generational terms. In the days when wines took longer to age, the truism was that you drank from the cellar your grandfather acquired, and bought bottles that your children and their children would one day share.

The Haudenosaunee or Iroquois confederacy is famous for its “seven generation” form of decision-making, in which leaders consider how today’s choices will affect descendants seven generations from now.

As climate change’s threats reshape businesses, this long-term view is taking hold in the most influential offices in the world. Ensuring the future requires a clear view of today’s operations and tomorrow’s repercussions, making location intelligence an invaluable part of achieving holistic sustainability across all facets of business activity.

Rolls Royce Goes Electric, Foreshadowing Industry Challenges

Widespread adoption of electric vehicles looms—but first, retailers need to take a geographic approach to sales across diverse markets.

The electric vehicle revolution has arrived—Tesla’s Model 3 was Europe’s best-selling car in September. That’s the same month iconic British automobile company Rolls-Royce announced that it will shift to an all-electric line-up by 2030, joining Jaguar, Bentley, Cadillac, and others that have committed to electrification.

Article snapshot: Rolls Royce decides to go all-electric, Tesla reaches $1 trillion in value, and automakers and dealers assess how they’ll navigate the future of EV sales.

For an industry that once seemed to many like a fantasy, it’s an exciting moment for EV evangelists. Real change is on the near horizon, but the journey will demand curated sales strategies, made possible by insights born of location intelligence.

Given the undeniable momentum, buyers might expect electric vehicle (EV) sales to sweep the globe. But in reality, it’s less likely to be a tsunami of change than a staggered evolution. Car buyers in some neighbourhoods and regions will be first-movers, while others will be much slower to adapt. Retailers and brands will need to calibrate supply not just to demand but to local infrastructure that supports charging and repairs.

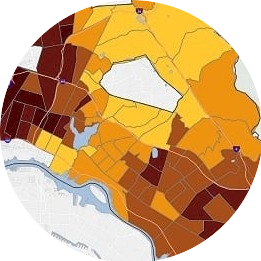

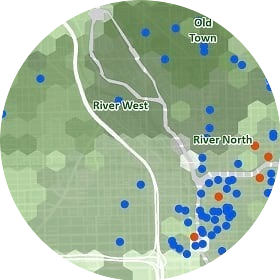

To date, US EV sales have been concentrated mainly on the coasts, often in higher-income neighbourhoods. As that picture develops, car sellers will need to customise EV offerings to specific markets and regions, plan production and distribution based on those market insights, and effectively advertise the new breed of low- or zero-emission vehicles to a complex and multifaceted group of drivers.

A Collaborative Approach to Market Change, EV Sales

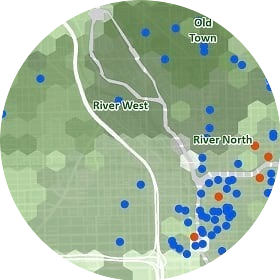

Spatial business intelligence, also known as location intelligence, will be a vital tool to help EV leaders forge this path. Retailers can use geographic information system (GIS) technology to analyse and contextualise multiple forms of relevant data on a map—from income, age ranges, and sustainability attitudes, to areas of higher EV adoption and electric grid capacity. The patterns and connections that emerge from this geographic approach help decision-makers understand the complexions of markets, define target areas, and forecast EV sales.

Managing the EV transition profitably will require multiple stakeholders to work in tandem. GIS supports this collaborative approach, serving as a common visual operating picture for multiple parties.

For example, a spike in EV sales will be problematic if the charging infrastructure isn’t in place to keep cars running. That’s why an Los Angeles-based team at the design consultancy Arup developed a web-based site-suitability tool for EV charging stations. Named Charge4All, the GIS-based tool enables businesses, utilities, government offices, and communities to share input on the most suitable locations for EV chargers. Past plug installation efforts in Southern California missed important variables when major stakeholders weren’t invited to the table. That’s why GIS, which can contextualise data from multiple software platforms, will be integral to the EV effort.

Sustainability as an Act of Resilience: By converting their fleets to electric drivetrains, automakers are fuelling two aspects of sustainability. They’re reducing negative impacts on the natural world by limiting emissions, and they’re strengthening their own resilience by adjusting business models to changing consumer preferences. Learn more about the two sides of sustainability in this WhereNext on-demand webcast.

Location Distinction with a Difference

Since widespread EV sales will require buy-in from multiple sectors of society, the Charge4All team ensured that lower-income and disadvantaged neighbourhoods were included in the suitability analysis. That spatial awareness illuminated key links between demographic information and EV use, underscoring the importance of analysing granular consumer data through a location lens.

For instance, the GIS lead on the Charge4All project found that the upscale, beachfront neighbourhoods of Santa Monica boasted high levels of EV adoption and usage. On the other hand, downtown LA showed more lower-income areas, lower rates of vehicle ownership, and less EV engagement.

This geographic differentiation holds true on a national level as well. According to data from the International Council on Clean Transportation, California accounted for slightly less than half of all EV sales in the country in 2019. The West Coast in general is a stronghold of EV use, with a pattern of high EV registration stretching from Seattle down to Phoenix. The Northeast and Rust Belt are also home to swathes of EV ownership. However, vast stretches of the South and the inland Northwest show virtually zero EV engagement.

Finding the EV Buyer Profile and Investing in the Right Markets

Understanding how geographic adoption trends shape the potential for EV sales will be key to the success of any retail strategy—including how to distribute cars to existing dealerships, where to invest in new ones, where to build charging infrastructure, and how to service customers’ vehicles. The approach in cities, where parking is scarce and residents cluster in apartment buildings, will differ from plans in the more dispersed suburbs.

To see the full picture, brand leaders need to synthesise data such as EV registration, inventory numbers, driving patterns, consumer demographics—even information about clean energy regulations. For example, some states offer incentives for zero-emission vehicles that can attract both buyers and sellers and provide clues on which markets to prioritise.

In states without EV incentives, higher-cost EVs might not sell as well. That fact alone creates a reason to marshal useful data and customise price points and products to the most EV-friendly customers in a market.

Columbus, Ohio, which has made a push to facilitate the shift to electric vehicles, found that those most likely to buys EVs tended to share certain demographic traits. Individuals with a bachelor’s or graduate degree who were between 30 and 44 years of age with an annual salary of $100,000 or more were ahead of the curve in making the jump to electric.

That’s the type of demographic and psychographic insight that GIS technology specialises in. Executives can view maps and dashboards of such insight to identify high-potential areas and facilitate collaboration with marketing and sales teams.

Location intelligence can help EV marketers see which types of customers live or shop within a 15-minute drive time of a store, as well as the sales performance of competitors in the area. The same capability can allow advertisers to target online ads to a particular slice of a market, like those who support green initiatives.

An Exciting Moment for EV Evangelists

When business analysts place all relevant data in front of decision-makers on a smart map, the unified picture catalyses creative solutions. For instance, workplaces that offer EV charging stations can be the deciding factor for buyers who are on the fence about an EV. A dealer could create a map of nearby office parks to scout potential partnerships that drive higher adoption rates. They could also share maps of EV chargers with potential customers, customised to their driving lifestyle.

Such targeted, location-based insights translate into higher EV sales—and less time and money wasted on uninterested customers.

The Post-COVID Office Takes Shape

As workers return to the office, companies are using indoor location intelligence to optimize the postpandemic workplace.

-

Businesses around the world are doubling as laboratories in a great post-pandemic experiment to define what the future of work will look like.

Article snapshot: Business and HR leaders are designing the workplace of the future by gathering data on office patterns and reimagining interior spaces. One company that used indoor location intelligence to ensure workplace safety during COVID is now using it to plan the hybrid office experience.

Two-thirds of companies are considering physical redesigns that facilitate hybrid work, in which employees split time working in the office and at home, Microsoft says. Google is dedicating roughly 10 percent of its work space, totalling millions of square feet, to experiments in hybrid design that include modular pods, inflatable privacy walls, and paneled spaces in which the faces of videoconferencing employees are prominently displayed alongside in-person meeting attendees.

Old ideas are being overturned for approaches that would have seemed radical two years ago. Personal desks may be a thing of the past: JPMorgan Chase CEO Jamie Dimon speculated that the bank may need only 60 desks for every 100 employees. Open floor plans, once thought to facilitate collaboration, have been shown to decrease face-to-face interaction—and increase the spread of germs. Desk layouts or corporate cultures that stress presenteeism—showing up and being visible to a boss or manager, even when sick—could damage a company’s ability to keep its workforce intact.

The outcome of this ferment isn’t yet clear, but as employees return to office spaces, companies working with indoor location intelligence are already edging ahead in a global race for top talent and workplace safety.

Indoor Location Intelligence Illuminates Pathways to the Future of Work

Before rearranging workspaces and practices, some business leaders are using a form of smart building technology to gather data and study patterns of engagement.

For example, COOs, HR executives, and facilities managers can learn from a phenomenon known to urban planners as “desire paths.” It’s common to see such walkways pounded into the ground on university greens by students who ignore sidewalks, proving some plans that look good in a blueprint don’t match the needs of real life.

In a business setting, management can commit the same error by instituting post-pandemic measures that send the best talent fleeing to employers who offer more innovative workplace options. Indoor location intelligence produced by a geographic information system (GIS) can help identify the desire paths leading to the future of work. A tech-enabled view of indoor spaces reveals how teams operate spatially and what types of spaces employees gravitate to. It’s a relatively new application of GIS technology, which for decades has guided the planning of global supply chains, sustainability, and national retail networks. As COVID-19 disrupts indoor spaces, GIS is increasingly being adopted to unlock insights in smart building data.

One design and engineering firm with headquarters in London and nearly 100 global offices has been using GIS to plot a safe, organized return to the office and visualize the new ways in which workplaces might operate. Employees can access the indoor maps to book a desk, locate colleagues, and orient themselves in offices. Administrators use the maps to optimize cleaning schedules, ensure that safety protocols and regulations are met, and monitor the flow of people through spaces.

The data and trends surfaced by this type of system support C-suite decision-making in an uncertain time, helping business leaders anticipate how their office footprint might need to change and how to craft work from home policies that cater to the needs and abilities of each department.

By April 2021, the design firm’s indoor location intelligence program had racked up 20,000 internal bookings with 1,500 staffers actively using it.

“There is extra information that we’re now using to [analyse] how are people using these spaces, and actually, do we need to change how we’re using our spaces? That’s going to be a big thing,” says one of the company’s digital leads and GIS experts.

There are a lot of things, particularly if we had new [hires], which made people a bit apprehensive about going to the office. So this just allowed people to understand: What does that office look like? How am I going to plan my route?

Digital lead

Self-Testing Postpandemic Office Solutions

Known for its nonhierarchical structure and free-thinking approach to problem-solving, the firm had begun experimenting with a desk-booking system in January 2020 when a renovation at the Wales office scattered employees around the building. Since people weren’t at their typical desks, colleagues had to hunt around floors to find each other. A rudimentary desk-booking or hoteling system to help workers find each other became a prototype for the company’s indoor location intelligence program.

When COVID hit in full force, the firm, which often advises clients on smart building applications, saw an opportunity to meet the moment through technology. They would use the spatial planning and data analysis tools of GIS on their own offices before advising clients of the benefits. “Coming from a software development background, there’s a phrase I like to use,” says one of the company’s product leadership directors, “we eat our own dog food.”

The digital lead and his team began scaling up the indoor concept during the lockdown period to prepare for a return to the office in spring and summer 2020. As employees began trickling back into buildings, company executives focused on safety, cleanliness, and calming the nerves of an anxious workforce.

Even before stepping foot back into the office, new and returning workers could look at smart maps to familiarize themselves with the updated space layout and identify where bathrooms, hand wipes, and sanitizer stations were located. At an office where many people bike to work, it was even possible to book time slots for on-premises showers.

Using spatial simulation, the program designers could forecast the flow of people through hallways and offices and see how that might create crunch points or overcrowding. These insights were fed into GIS-based apps that gave employees turn-by-turn directions to navigate the office and avoid congestion. The technology also helped administrators understand how to situate desks to comply with social distancing measures.

What does our office of the future look like? How much of our space should be collaboration spaces? Using a dataset like [the one] we're capturing gives us a huge amount of evidence to understand and scenario plan.

Digital lead

What a Spreadsheet Won’t Show

When the facilities manager at the London office heard of the project, she immediately asked to enroll in the development process. The office she runs is massive, covering 20,000 square feet per floor across five floors, as well as basement and ground levels. Prior to implementing the GIS indoor technology in November 2020, she and her team had been using a spreadsheet to track who was coming into the office and which desks they were using. At first, it was 200 employees, then 300, and before long the number was creeping toward 400. “There was no way we could do that with a spreadsheet,” she says.

The GIS indoor-mapping program integrated with the London office’s hoteling system. It empowered employees to locate their own seats and made it easy for them to find colleagues by glancing at a smart map or searching by name. The facilities manager knew the accurate number and location of employees each day, which helped her locate enough fire marshals and first-aid responders on each floor.

Adding to workplace safety, the indoor program’s ability to remember where employees sat throughout the day enabled a track-and-trace capability. If a COVID outbreak were to occur, the company could warn any employees who might have been exposed.

The hoteling system and indoor location intelligence also paved the way for solving broader operational issues occasioned by the office’s size and complexity. The facilities manager linked the hoteling platform to an online learning course that educated employees on how to navigate the building safely; they could only book a desk once they had completed the course. The system also enforced a rule that a new floor would only open for booking when the floor below had reached 75 percent capacity. This encouraged the efficient use of cleaning and energy resources.

Hybrid Era Workplace Design

While indoor location intelligence brings efficiency to daily office operations, it also unveils insights of a higher order. The design firm’s HR leaders found data in GIS that helped shape the hybrid work paradigm. For example, Thursday was the most popular day to be in the office, and junior workers booked desks more often than senior employees, most likely because they feared remote work would hurt their chances to grow. These findings could inform C-suite decisions about which days to make mandatory for in-office work, if any. (Some companies have begun insisting that executives work remotely a few days a week, along with the rest of the staff, to avoid in-office employees gaining an unfair advantage over remote workers.)

As a multidisciplinary company, the design firm had a vested interest in ensuring that different teams interacted. The indoor location intelligence program made it possible to book “neighbourhoods” of desks in various configurations. Instead of marketing always sitting next to sales, they might rub shoulders with members of the IT team one week, or executive leadership the next. These reconfigurations could spark the kinds of ideas and innovations that the office of the future will be expected to produce.

Spatial usage patterns in the office, supplemented with data like employee surveys, could inform decisions unique to the hybrid era. Based on that data, a COO might choose to shutter a sprawling urban headquarters in favour of smaller, cheaper satellite locations in the suburbs. On a more granular level, spatial insights could push leaders to invest in cutting-edge solutions like virtual reality or augmented reality to unite a geographically fragmented staff.

We want to know, how well are the ‘market square’ areas used? Have we got the right furniture in there? Are we supporting the business in the correct way?

Facilities manager

The Hidden Geography of Office Life

Unwritten spatial rules quietly shape much of office life: an alcove well suited to sharing gossip, an elevator where the CEO might be caught on the way to lunch, a staircase that makes it easy to slip away for an early exit. Indoor location intelligence helps uncover trends in office geography and turn them into better workplace design. If, for example, no one books desks in a certain section of a floor, managers might consider whether there’s an issue with lighting or temperature control in the area. If groups of employees tend to work in the office on certain days, managers and HR executives can find better configurations for collaboration.

These are the kinds of workplace challenges business leaders will need to address, and indoor location intelligence can guide decisions on the future of work. “I think facilities management is going to become more of a crystal ball,” predicts the engineering firm’s London office manager. “You’ll know what it is that people want before they know that they want it, because you’ve got the data and because you’re seeing the trends and patterns.”

How Climate Change Is Shaping Real Estate Investments

Home buyers will now see a climate risk score on their dream house. Will it change where they want to live?

In a move that could alter the practice of buying and selling homes, real estate broker Redfin is adding climate risk scores to sale listings. Home buyers can now evaluate climate risk the way they assess local schools, tax rates, and neighbourhood appeal.

The new data addresses the public’s growing interest in understanding the shifting nature of risk. It’s a pursuit shared by business leaders, many of whom already use geographic information system (GIS) technology to anticipate climate shifts and adjust investment strategies accordingly.

Article snapshot: A major real estate player introduces climate risk scores for homes listings, and the effects could ripple through industries far beyond residential real estate.

Climate Risk on Buyers’ Minds

Nearly 80 percent of current and potential homeowners told Redfin they’d be hesitant to buy a home in an area with frequent or intense natural disasters. In the same survey, nearly half of people planning to move in the next year indicated that extreme temperatures and increasing natural disasters played a role in that decision.

Given the weather disruptions that have already beset many areas of the world, it’s no surprise that home buyers and businesses are considering climate risk in their investment decisions. In each of the past 40 years, the United States averaged seven weather disasters costing more than $1 billion (adjusted for inflation). But in just the past six years, the average number of $1 billion events per year was more than 15, according to NOAA data. These events can devastate homes, businesses, neighbourhoods, critical infrastructure, and supply chains.

GIS-generated location intelligence has long helped companies respond to weather events. Now, its ability to model long-term weather patterns and related climate risk could shape real estate investments for individuals and organisations.

Assessing Climate Risk—A New Normal for Real Estate?

Climate risk data similar to the kind Redfin now provides is not only valuable in home buying but also increasingly important to commercial property investment decisions. Commercial real estate leader CBRE estimates that 35 percent of global REIT properties are exposed to hazardous climate events such as inland flooding and hurricanes.

To create more resilient investments, real estate investors are increasingly using climate risk data to make decisions in locations susceptible to climate change, according to the Urban Land Institute. But they’re not evaluating climate risk alone; they’re also factoring in efforts by cities to increase resilience to climate change.

In industries like commercial real estate, telecom, and retail—where choosing the right location is key to the bottom line—predicting climate impacts on potential investments is becoming a competitive advantage.

For example, engineering, design, and project management firm Atkins uses GIS technology to perform climate modelling, drawing on the precision of GIS-produced location intelligence to steer clients toward safer investments and ways to fortify their supply chains.

Atkins’ simulations use predictive analytics to create location intelligence on climate scenarios. The resultant GIS map shows how tropical storms or extreme temperatures might disrupt the flow of shipping containers across global supply lines years from now.

Tailoring Investments to Population Growth or Decline

As more people turn to climate change data for guidance on where to live and work, businesses are keeping a close eye on how populations shift. The location of everything from a new retail storefront to a same-day fulfilment centre to an office complex could turn on those outcomes.

Over the past 18 to 24 months, business planners have worked to understand population migrations, with varying levels of success. The COVID-19 pandemic, remote work, and climate-driven location decisions like those observed by Redfin have muddied the waters. But organisations with high levels of location intelligence have enjoyed more clarity.

They’re using GIS analysis to detect shifting sales locations, changing travel patterns, and cities and neighbourhoods where populations are growing or declining. As climate risks alter the places where people buy houses and organisations build businesses, industry leaders will use that clarity to adjust their investments.

NextTech: Monitoring the Global Supply Chain in Real Time

By tracking how global supply chain disruptions impact finished goods, a real-time dashboard gives executives an edge in risk assessment.

It was a wake-up call like no other: Ask a global supply chain executive or COO what types of scenarios keep them up at night, and there’s a good chance you’ll hear about the 2011 floods in Thailand.

Article snapshot: For executives overseeing a global supply chain, operational awareness comes from a real-time dashboard that tracks:

- Company and supplier operations

- Facility threats or disruptions (e.g., storms, floods, fires)

- Number of employees at each facility

- Potential impacts on production of finished goods

Monsoonal rains and tropical storms led to the worst flooding the southeast Asian country had seen in 50 years. One of the worst-hit areas was the Chao Phraya River basin located near Bangkok: a manufacturing powerhouse that produces up to a third of the world’s hard drives.

The weather-related destabilization ricocheted throughout the global supply chain. Losses inside Thailand totalled as much as $50 billion as industrial output in the area was halved. Japanese car manufacturers operating facilities there had to suspend production, resulting in major profit losses. In response to flood-related stoppages, Sony downgraded its full-year operating profit outlook by 90 percent. HP said it would experience hard drive shortages through Q2 of 2012.

Business leaders have learned a lot about supply chain vulnerabilities since, but the danger of global supply chain disruptions due to extreme weather, in particular, continues to grow.

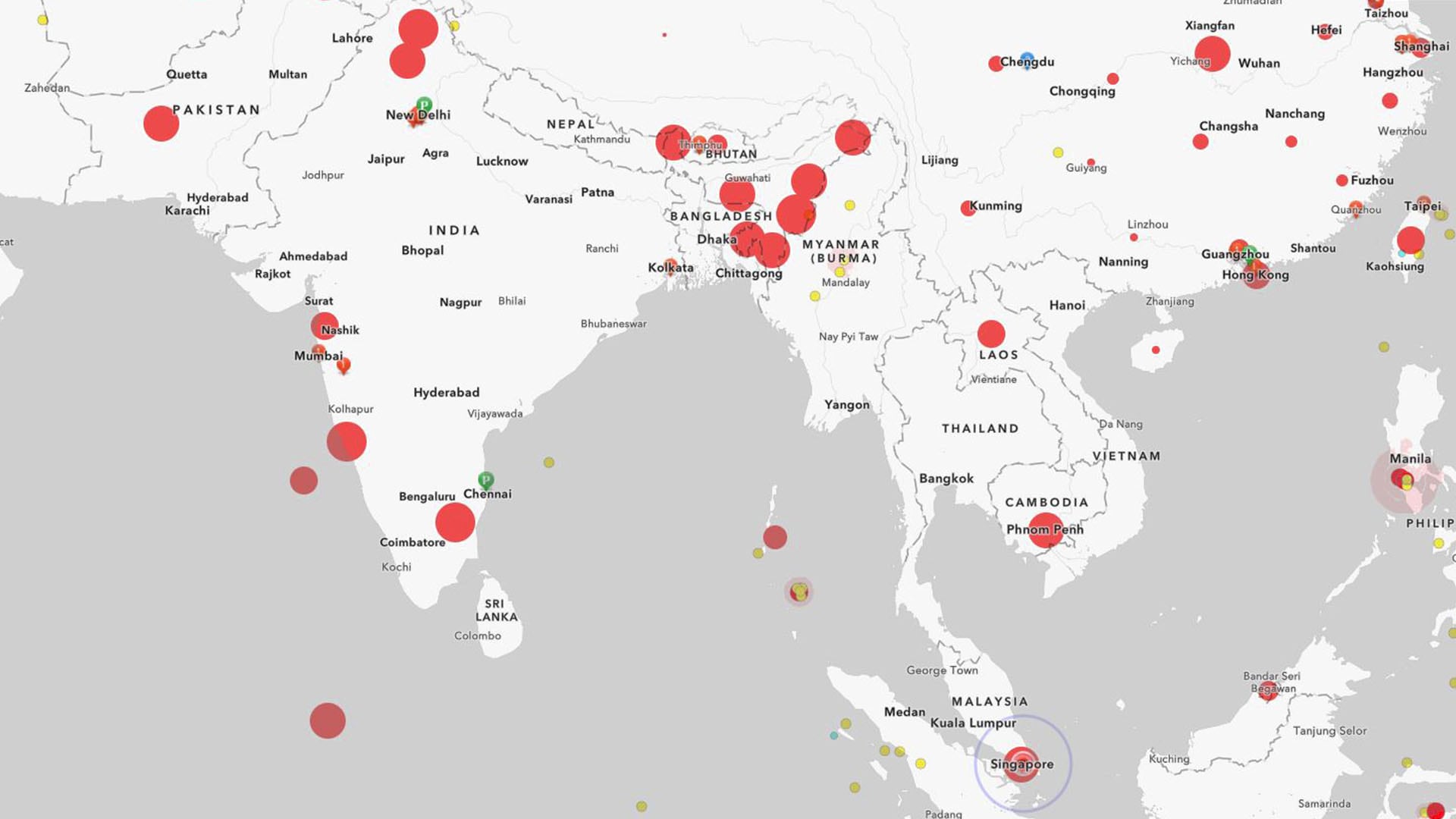

With the volume of manufacturing currently concentrated in China, for example, 50- or 100-year floods there could dwarf the effects of Thailand’s 2011 floods. US officials saw flooding outside Wuhan delay shipments of much-needed PPE last year. These conditions underscore the importance of businesses having access to granular information about how weather patterns intersect with factories, supplier facilities, and global supply chain routes.

Global Supply Chain Resilience Grounded in Data

In today’s economic landscape, business resilience begins with awareness, and awareness begins with data. For an executive overseeing a global supply chain, a dashboard powered by a geographic information system (GIS) provides a way to organize data and contextualize the location and magnitude of potential impacts.

This video demonstrates the practical use of a dashboard in monitoring a global supply chain across a variety of factors, from weather to COVID-19 cases to fires.

The interactive map allows a decision-maker to absorb data quickly: Pins indicate the status of facilities stretching across the company’s global footprint. Green and blue dots indicate plants and tier 1 and tier 2 suppliers operating normally, while red dots signal operations facing threats.

Executives can see not only how many plants have been disrupted but the consequences of these disruptions, including the percentage of affected parts or finished goods.

Clicking on a facility produces a window with data on the location’s number of employees, typical daily production volume, and risk measures for events like floods. An executive trying to determine the possible impacts of a coming storm can zoom in and gauge the distance to coastlines or nearby facilities that could serve as temporary storage if a warehouse is knocked offline.

Awareness to Mitigate Losses

A McKinsey study found that firms that plan ahead for climate-related incidents can limit revenue losses to 5 percent, versus losses of 35 percent for unprepared players.

GIS technology provides business decision-makers with situational awareness through location intelligence, weaving layers of information into one view. Real-time data on weather threats, the status of facilities, and patterns of past storms act like an intelligent nervous system that helps C-suite leaders understand the impacts and know how to respond effectively and quickly.

GIS-based smart maps can even forecast weather impacts on a specific product component or raw material, allowing organizations to issue warnings or shift production to secondary suppliers. Companies including AT&T and one of the world’s largest retailers rely on GIS analysis to understand weather-related threats across networks of stores or cell towers.

Seeing the Threat Matrix in the Global Supply Chain

By toggling data layers on or off, an executive can study threats posed to specific geographic areas or particular tiers of the supply chain.

If flooding is threatening the east coast of Asia, an executive can focus on that region and consult infographics alongside the map to see how many plants and suppliers will be affected. By tracking the goods and components produced by each facility in the supply chain, a GIS dashboard reveals how downtime at a plant producing fasteners or seat levers will affect the flow of finished goods at a factory thousands of miles away.

With GIS technology, decision-makers can also turn on data like COVID infection rates to understand other risks to the business.

Each piece of supply chain data is useful on its own, but data becomes more valuable when viewed in the context of geography and broader impact. GIS dashboards create that comprehensive view, pulling together multiple data sources and yielding the insight that businesses need to build resilient supply chains that are as agile as they are efficient.

Tracking Meatless Menus and Other Trends

When consumer preferences change, retailers, manufacturers, and service providers need to keep up.

Daniel Humm, owner and head chef at Eleven Madison Park (EMP) in New York, had big news this spring. His upscale restaurant—one of only 13 in the US to earn three Michelin stars—would henceforth be strictly vegetarian. It was like BMW announcing it would discontinue car production to focus on its bicycle line.

Article snapshot: A world-renowned restaurant kicks meat off its menu, while other companies test-market imitation meats. When consumer preferences change, businesses need to know where to make their own adjustments.

Few businesses contemplate—let alone implement—such a radical rethinking of product offerings. But any change—whether carried out by a small restaurant, regional brand, or national franchise—requires a close understanding of what customers want and how much change they will tolerate. Companies often can find this insight in data related to consumer preferences and psychographics, viewed through the lens of location intelligence.

Consumer Preferences in Flux

The change Humm is bringing to EMP is undeniably bold. As the Wall Street Journal noted, Humm, like most prestige chefs, built his reputation on meat and seafood dishes. Worldwide, Michelin awarded three stars to just one vegetarian restaurant this year: King’s Joy in Beijing.

But Humm’s announcement, made as the city began to relax coronavirus-related occupancy requirements, was also well-timed. As the world wakes up from the COVID-19 pandemic, change is in the air. A recent Forrester study found that 75 percent of us say the pandemic will lead to long-term changes in our behaviour and experiences.

Evidence suggests that interest in plant-based diets could be part of this reappraisal. A study commissioned by Proagrica, an agriculture and animal health technology company, found that nearly 20 percent of people in the UK ate more vegetarian food during the first year of the pandemic, and the same percentage plan to make the habit permanent. An especially intriguing data point for the restaurant industry: nearly 40 percent of respondents said they would consider ordering plant-based meat alternatives in restaurants, including fast-food establishments.

As savvy businesses adjust their offerings to acknowledge these and other consumer changes, they would do well to rely on location intelligence as a guide, because it reveals where important trends and consumers may intersect and can help assess new approaches and strategies.

Sensing Consumer Preferences Geographically

For a retailer, manufacturer, or service company considering bold changes, the first step is to understand what its customers and potential customers want. Just as it would be foolhardy to increase umbrella inventory in a desert region, it makes little sense to sell novel items or experiences in areas where the demographics and psychographics don’t indicate support.

When Carl’s Jr. tries to sell customers on its plant-based Beyond Famous Star Burger, and Del Taco promotes its Epic Beyond Original Mex Burrito, they want to know where such products are likely to be successful. To that end, many companies, including restaurant chains, apply a location intelligence strategy when they optimize their locations and their offerings.

For instance, using a geographic information system (GIS), some companies analyse anonymized social media data to understand consumer preferences in certain locations. A chain planning where to introduce vegetarian options might use GIS to identify geographic clusters of people who voice support for animal rights or plant-based diets. Human mobility data—similarly anonymized—can reveal consumer preferences and patterns much as it revealed social distancing practices to public health officials during the COVID pandemic.

On the Move

Not only are tastes and habits shifting in ways that can be hard to grasp without the help of location data, but people’s physical locations are as well. Overall, the number of people making permanent moves has increased modestly since the start of the pandemic—but certain metro areas are experiencing dramatic shifts in population size or makeup.

As companies contemplate major changes in the post-pandemic environment, they’ll want to delve into these demographic shifts to better understand market potential.

Using GIS, companies can analyse the demographic breakdown of urban, suburban, and rural markets and, through smart maps, visualize the location of certain buyer personas. They can even enlist the AI capabilities of GIS capabilities to uncover consumer clusters that are not immediately apparent.

Strategic-minded brands round out that analysis with psychographic insight on consumer preferences. Psychographics can be useful in discovering geographic locations with high concentrations of people concerned with wellness lifestyles, for instance. The same techniques could reveal areas where healthy eating is a primary concern. Savvy GIS analysts create maps showing these patterns, providing product marketers, merchandise planners, and real estate executives with useful intelligence for near-term and strategic plans.

As the world emerges from what we can only hope is the worst of the pandemic, shifts in consumer preferences are likely to accelerate. Companies can make the most of these changes by anchoring data in a coherent framework of location intelligence.

Spotting New Business Opportunities in Consumer Data

The pressure to develop new business opportunities is driving digital and traditional companies toward more precise market analysis.

Consumer behaviours and interests are changing too fast for historic “set it and forget it” market analysis to keep up. Companies stay relevant during changing times by excelling at sensing trends and creating new products and services to answer emerging needs.

Whatever the industry, spotting trends and responding effectively to those signals requires the right mix of data, analysis, and business agility. Location intelligence generated by geographic information system (GIS) technology adds an important dimension to that practice, enriching an organization’s decisions with a broad scope of consumer data and the ability to reassess market conditions wherever, whenever.

Imagine antennae smart enough to capture how customer needs and preferences are evolving from week to week or from month to month. Then, picture decision-makers enhancing experiences and product lines in response to those signals. Unlocking that potential starts when organizations design the right blueprint for change.

Article snapshot: Business leaders need sensitive antennae to spot new business opportunities. This article shows how digital-first companies and brick-and-mortar businesses can borrow useful techniques from one another as they build new offerings for customers.

Customer Understanding Must Be Current and Local

Some innovative companies already zero in on consumer signals to predict demand for new businesses and service lines. Consider Airbnb, which added monthly stays to its offerings when the pandemic fuelled interest in lodging for workcations and other creative alternatives to the monotony of home confinement. DoorDash grew its provider base by launching a white-label delivery solution geared to small, local restaurants—a response to the growing demand for take-out food options. Both companies listened to the changing needs of customers and suppliers, then adapted quickly.

Other businesses are using location intelligence generated by GIS to reveal changing customer interests in certain locations. A GIS analyst can cull data on foot traffic patterns, for instance, to discern the demographics and psychographics of people who frequent the area. Product- or service-based businesses have used that insight to establish new locations, plan store merchandise, and dynamically shift pickup and delivery options. Now industry leaders are using it to develop entirely new offerings at a pace that matches the market.

Wherever a company falls on the digital spectrum, layering location intelligence into an iterative approach to business growth provides a new way to understand consumers.

Digital-First Companies Seek New Data Sources to Spot New Business Opportunities

The digital enterprise is inherently grounded in data. From their founding, these organisations have maintained connections with customers via websites, apps, social media, email, and other channels. Through those touchpoints, digital-first companies sense trends even as they’re taking shape. They see when customers gravitate to a new style of eyeglasses on an augmented reality app, for example, or when social media chatter indicates growing interest in a new type of service. Even so, that system is only as good as the data feeding it. Listening to additional information channels can help digital enterprises further personalise products and services.

That ability counts for a lot. While 93 percent of companies rely on survey-based metrics to measure customer experience, only 6 percent of leaders are confident their system is actually enabling strategic and tactical decision-making. For some digital organisations, the answer may be to rely on not just information gathered through existing connections, but also a wider range of data, on a more frequent basis. Additional capabilities like location intelligence help reveal nuances in customer preferences that can lead to valuable business opportunities.

Through GIS technology, companies can capture and analyse data to evaluate where their consumers are coming from and what their interests are. By mining online searches or social media feeds, for example, the founders of an upcycled apparel brand might identify hidden demand for fair-trade beauty products in certain geographies and develop a line of skin care products to complement their apparel business.

A GIS analyst can create smart maps of emerging demand patterns, buyer preferences, demographics, and psychographics to assess any market—not just during a company’s initial foray into the market, but on an ongoing basis. By reading those geographic signals on a more frequent basis, a company can stop being reactive and start adapting based on what’s likely to happen next, deepening connections with customers and prospects.

The ability to sense the market direction helps even the most digital enterprise continue creating customer experiences that strengthen engagement, engender loyalty, and differentiate brands.

With location-based insight, businesses can tailor service and product offerings to emerging interests in specific markets.

Brick-and-Mortar Operations Tap into New Levels of Understanding

The days of assessing a trade area or addressable market before moving in, then putting that analysis on the shelf, are long gone. Effective selling now requires an understanding of where customers are best engaged as well as how and when to interact with them in meaningful ways.

Brick-and-mortar or omnichannel companies that rely on traditional market analysis now have access to new sources of data around human movement, location intelligence, and consumer transaction trends—as well as the technology to assess that data seamlessly.

This doesn’t mean businesses must unlearn everything they know. Instead, companies can build on a foundation of demographic and psychographic data by incorporating more digital capabilities that round out customer understanding through location intelligence. When a store uses GIS to analyse and visualise information, it can in turn offer more tailored experiences that deliver exactly what people want, exactly where they can derive the highest value from it.

During the pandemic, executives at a company that provides vehicle services may have sensed customers’ reluctance to visit repair shops. With the help of location intelligence and an agile team, the executives could launch a mobile business delivering at-home services like oil changes or minor repairs. The analytical capabilities of GIS allow innovative companies to plan service and delivery networks so that employees travel efficiently through the workday and reach customers when they’re expected.

The GIS team at a beauty supply chain might analyse recent foot traffic data and discover that store customers often visit a salon before or after their shopping. To capitalise on that demand, the company might pilot in-store salons in geographic markets where the trend is most pronounced.

GIS-backed location intelligence shows brands where customers are located along with what people in those areas value, how they prefer to shop, and how preferences change across months or years.

Meeting Consumers on Their Journey Begins with Better Data

For digital leaders, reliance on data from direct customer interactions—whether a sales transaction history, in-app behaviour, or human movement—is giving way to a more holistic approach.

Well-rounded, recurring market analysis allows organisations to grow faster than market average by continually adding more tailored products and services that capture the interests of new and existing customers. Wherever a company falls on the digital spectrum, its analysts and decision-makers can respond better to customer interests and innovate offerings by incorporating a location-specific customer understanding into their business planning.

This article was originally published on the global edition of Wherenext

A Growing Company Enlists the Four A’s of Location Intelligence

With artificial intelligence, automation, cloud-based architecture, and analytics, an insurance company executes an ambitious growth plan.

Sometimes it takes an audacious, even intimidating goal to inspire a company to find new levels of innovation.

Article snapshot: Facing an ambitious revenue target, an innovative company employed new digital techniques, including the four A’s of location intelligence, to expand its business and stay ahead of the competition.

That was the thinking behind the ambitious growth strategy launched in 2016 by an insurance firm based in the Midwest. With agile startups beginning to crowd the insurance market, company executives sought to reach more commercial and personal clients who could benefit from the firm’s high-touch, consultative approach. The senior leadership team set a goal big enough to catalyse new approaches to reach that customer base: grow its annual premium by hundreds of millions of dollars—responsibly and effectively for customers.

The growth plan was two-pronged: find new clients in existing markets throughout the company’s multistate territory, while also expanding into new geographies. Since the company sells policies through a network of thousands of independent agencies, executives needed to understand which offices and geographies showed the greatest potential for growth—and they had to do so using data to supplement their instincts. To expand at the scale and pace of the strategic plan, company leaders knew they needed data technology that could pinpoint and predict high-performing opportunities. They didn’t realize that would lead them to the four best practices of location intelligence.

Mining Data for Competitive Advantage

One of the first steps C-suite executives took was to hire a data and analytics officer from a financial institution—an industry where the ability to mine information for competitive advantage was already a main differentiator of success. He then recruited a team of data scientists and analysts with experience in big data applications like machine learning algorithms.

Applying the Four A’s of Planning to Real Time Decisions

The four A’s of location intelligence give business leaders strategic insight to plan long-term investments. It also equips front-line workers with real-time information to make more immediate decisions—for example, relocating workers away from a storm or dispatching a driver to deliver mobile food orders to the most efficient sequence of addresses. For more on these “business decisions at the edge,” read this WhereNext article.

The company’s aggressive growth plans were not without complications. Insurance providers must expand carefully—by appropriately pricing the risk they take on and monitoring the amount of risk undertaken in any one market.

This required a granular understanding of the benefits and hazards of territories where the company planned to expand. By employing a geographic information system (GIS), the data science team could use location intelligence, or location-based business insights, to uncover promising new business avenues while protecting the firm from excessive risk.

“We believe it’s a competitive advantage,” says the company’s chief strategy officer. “The increase in the amount of data available, the variables available, the computing power available, the tools available—it’s going to separate winners and losers over time, and we intend to be a winner.”

The Four A’s of Location Intelligence

The data science team maximized the impact of location-based insights by employing complementary technologies and executing on the four A’s of location intelligence: analytics, cloud-based architecture, artificial intelligence (AI), and automation.

Analytics lay at the heart of the work done by the team, as they used GIS technology to segment the entire United States into millions of grid cells complete with over 1,000 variables, including demographic, geographic, and firmographic data. This data-rich grid acted as a basemap for growth, delivering geospatial context on which regions were fertile for business opportunity, while spotlighting risks like coastal flooding or earthquake activity that might weigh against issuing certain policies.

AI, in the form of machine learning, paired with GIS (a combination known as GeoAI) enabled the data science team to create algorithms that predicted the revenue potential of regions and ranked the performance potential of agencies the company might partner with. Automation sped up processes and made analysis more efficient, saving costs and streamlining labour. A cloud-based architecture supported the massive computational effort required to crunch millions of data points and support machine learning engines.

With those four pillars of location intelligence in place, employees from sales managers up to the CFO could make decisions knowing they had access to the best information and location-based data. “We’re getting new insights about what’s working and what isn’t in our business, and then deriving actions as to what we should do about it,” the analytics officer explains. “Then we can predict and scenario test what’s likely to happen. That hedges our investment in a really positive way.”

A few years into the expansion effort, company leaders can already point to success, enabled in part by the data-powered efforts. The firm has grown its commercial lines premium by almost a third since 2016. Over the same period, the average premium per agency has increased by 115 percent.

Powered by data savvy, an innovative corporate culture, and location intelligence, the company is on its way to attaining its strategic goals and outperforming the industry on growth and profitability.

Finding New Leads with Machine Learning

The machine learning algorithms core to the company’s data-powered growth helped accelerate and improve market analysis. The analytics team employed AI to comb through enormous datasets and produce conclusions and predictions on a scale the human mind couldn’t match. Combined with geographic context from location intelligence, machine learning algorithms gave executives insight on where growth looked most promising.

By feeding the algorithms huge amounts of company and third-party data, the analytics team could teach models to recognize the variables that signal growth potential. Based on analysis of historical patterns, the algorithms can recognize that an agency located in a town with a certain set of demographic and geographic attributes should generate a certain level of business.

The resultant GeoAI-powered map helped automate processes, saving the sales team hours, if not days, by singling out the best leads for new distribution points in areas where the firm had no presence.

Instead of guesswork, decision-makers draw conclusions based on facts and patterns surfaced by AI.

A Map Key to Communication and Risk Assessment

The segmented smart map made it easier to share information related to the growth plan across departments. Instead of searching through files or charts, colleagues consulted a GIS-powered dashboard showing the location of partner agencies, competitive agencies, and possible areas of expansion.

The analysis was further refined to reflect different lines of business, which depended on different data inputs and were projected to grow at varying rates. Using GeoAI-based analytics, the team segmented those variables and delivered useful smart maps to executives responsible for each line.

When we talk about GIS . . . it can apply to all aspects of our business, whether that's identifying where customers are and what their needs are, or distribution.

Chief strategyofficer

Risk Assessment in the Age of Climate Change

Executives knew that growth at any price wasn’t smart growth, so they focused on sustainable ways to expand. Location intelligence enabled them to move into new territories at a fast clip while sidestepping rising threats from climate-related volatility and natural disasters. Company underwriters could look at current policies and literally see on a map where they stood in relation to existing or potential hazards.

For example, the data analytics team helped build a tool that allowed underwriters to plug any address into a search bar. An automated geocoding service calculates how far that point is from the closest shoreline. This capability gives underwriters a better sense of threats to a property or business from events like hurricanes or other severe weather, resulting in an analytics-backed assessment of whether to assume the risk in the first place.

A Faster Route to Processing Claims

In addition to boosting the company-wide growth plan, the data science team helped streamline daily operations at the insurance firm. Smart maps allowed claims managers to speed up what was once a multistep process of organizing claims and manually plotting them with pen and paper. With the help of GIS, managers can now document all the day’s claims on a dashboard, and dispatch adjusters based on their suitability to handle the claim as well as their geographic proximity. The technology also helped adjusters optimize routes so they weren’t doubling back or wasting miles on the road—saving time for themselves and their clients.

Underwriters used the same tool to analyse existing policies and identify misclassified risks. Some policies were actually closer to the coastline than had initially been recorded, while others were farther away. In both cases, accurate geospatial insights helped the company fulfil the core business function of appropriately taking risk.

Automation aided the process by adding new or updated data to the national grid. “That’s a big time savings just from a model maintenance standpoint,” the analytics director says. “It frees up our data scientists to do more value-add work rather than updating and changing data.”

The four A’s of location intelligence also make it possible to contextualize information that might otherwise be treated as disconnected data points, discarded, or shrugged at in other firms. Instead, analysts were able to discover patterns that make the company more competitive.

For instance, a hot spot analysis of claims around one Ohio city revealed areas where customers were reporting damages at higher levels than seen in the past. By overlaying data like population growth over the geographic clusters where claim activity increased, managers could determine whether the uptick was simply due to a larger volume of residents. That insight could trigger the company to allocate more claims adjusters to the area.

Alternately, if those claims happened to coincide with clusters of hail storms or other climate-related trends, the information might lead executives to slow the pace of policy writing there, or change the kind of products available.

The future is: how do we leverage . . . additional data variables, how do we become more predictive, and how do we manage the risk more effectively?

Chief strategyofficer

A Suite of Data Technologies

Company leaders began with an ambitious goal, then put the right talent in place. The data science team translated the strategic ambition into algorithms and smart maps that could point the company toward growth, agency by agency, juxtaposed against potential risk. That GIS-powered location intelligence was made possible by a suite of technologies working in tandem: the insights of analytics, the predictive modelling of artificial intelligence, the efficiency of automation, and the processing power of the cloud.

“Whether it’s our heat maps or our competitor footprint on there, everyone gets it,” the analytics director says. “It’s immediately obvious what you’re trying to do. You want quick understanding, you want recall, and hopefully it drives quick action. To me, mapping does those things.”

This article was originally published on the global edition of Wherenext

DICK’s Sporting Goods Strengthens Omnichannel through Brick and Mortar Planning

For data-savvy DICK’S Sporting Goods, an optimized network of brick-and-mortar stores remains critically important to customer engagement.

A cursory glance at recent business headlines would seem to tell a straightforward if grim tale for traditional stores: e-commerce is ascendant, while brick-and-mortar struggles to remain viable.

Article snapshot: The largest sporting goods retailer in the US is using a creative team of analysts and GIS technology to:

- Guide the expansion of its market-leading store network

- Gain a deeper understanding of the relationship between online and brick-and-mortar sales and how to expand its personalisation strategy

- Inform its foray into groundbreaking forms of retail

An April UBS report estimates that 80,000 US retail locations—or close to 10 percent of total stores in the country—will shutter by 2026, while e-commerce sales will rise to 27 percent of total retail purchases.

But those numbers don’t tell the whole story. Data-savvy retail companies are blending the two modes of shopping into an omnichannel strategy that can spark business advantage. Rather than framing online and physical sales as a zero-sum contest, leading executives recognize that stores and e-commerce can actually boost each other—a phenomenon known as the halo effect.

The largest sporting goods retailer in the US has taken this approach and emerged from the coronavirus pandemic stronger than ever. Bucking what some might think of as conventional wisdom in the era of one-click shopping, DICK’S Sporting Goods is adding to its network of brick-and-mortar stores to complement a growing online presence. Whether customers are browsing aisles of basketballs, lacrosse sticks, and running shoes, or swinging by for curbside pick-up of online orders, DICK’S strategically placed locations act as important customer engagement points in a thriving omnichannel network.